All commercial business operations are liable to trade tax. Although trade tax is regulated by federal law, it is a municipal tax with rates varying at the municipal level.

Who is liable to trade tax?

Irrespective of their legal form, all commercial business operations in Germany are liable to trade tax (Gewerbesteuer).

Trade tax rate

-

The trade tax rate is set by local authorities which means it can vary from one municipality to the next.

-

The rules for determining the taxable income (business profits plus certain statutory additions and allowances) are the same throughout Germany. Moreover, the trade tax rate is the same rate for all businesses within one municipality.

-

The minimum trade tax rate must be at least seven percent. There is no statutory ceiling of the trade tax rate, but the German average trade tax rate is slightly above 14 percent.

-

As a rule, the trade tax rate tends to be higher in urban locations than in rural areas. The solidarity surcharge is not levied on trade tax.

The corresponding rate of trade tax depends on two components:

3.5 percent

Multiplier (Hebesatz)

The taxable income of the company is multiplied with the tax base rate (3.5 percent) which results in the so-called tax base amount. The tax base amount is then multiplied with the corresponding municipal multiplier, which results in the sum total of trade tax which is due.

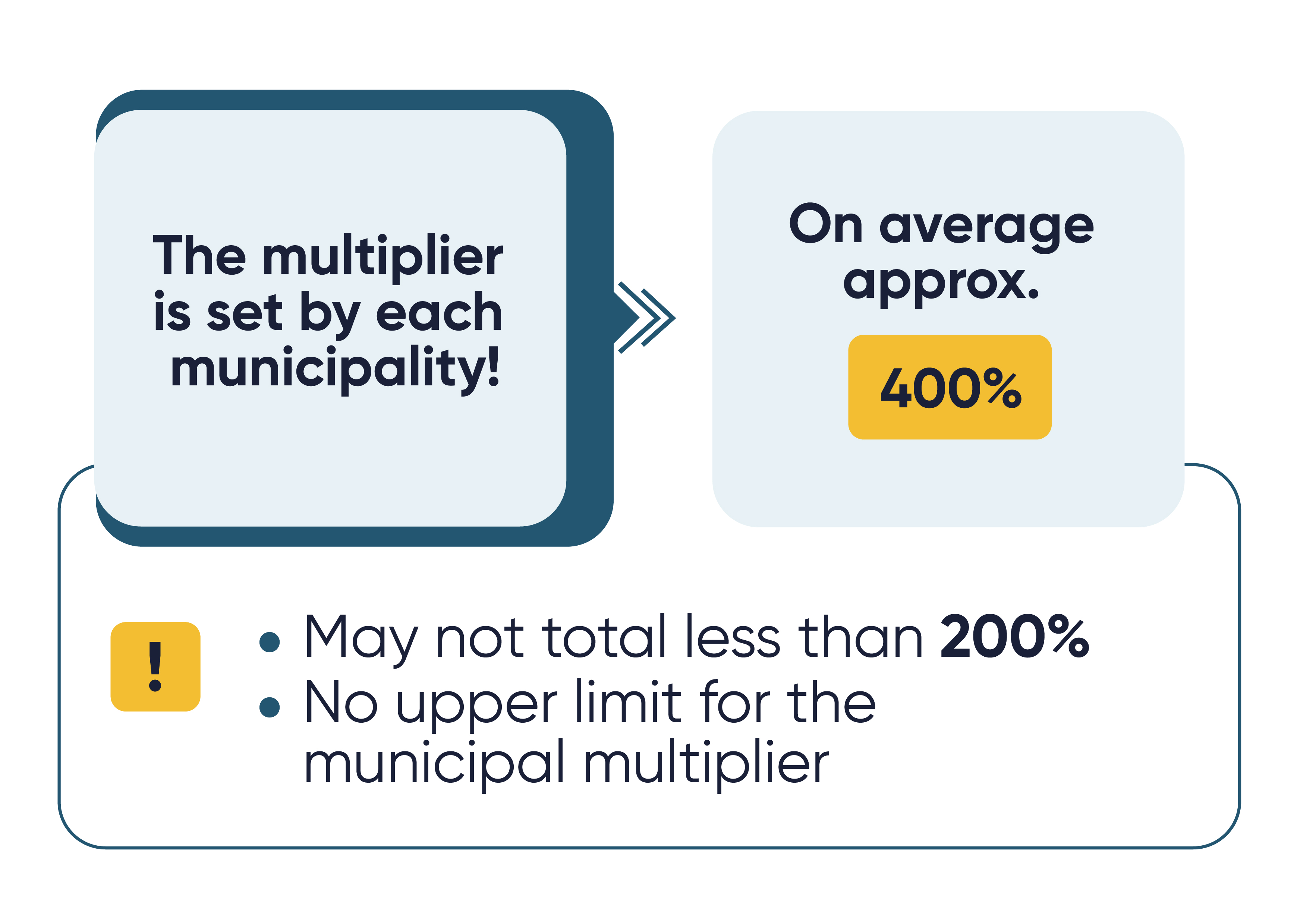

The multiplier is set by each municipality. On average, it is around 400 percent but may not total less than 200 percent. There is no upper limit for the municipal multiplier.