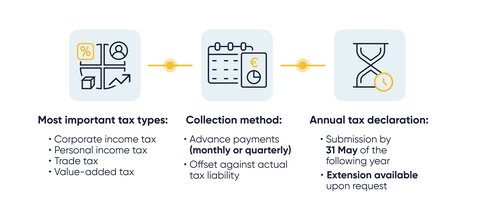

Tax declarations

Companies must submit a tax return to the tax authority once a year. The tax office at the location in which the corresponding company has its (German) head office is responsible.

Registration at the tax office

A regular tax number for the purposes of German income tax and national German VAT is issued by the competent local tax authority. Within one month of establishing a company or permanent establishment, a tax assessment questionnaire (Fragebogen zur steuerlichen Erfassung) must generally be filled in online via the official German tax portal ELSTER (German language only).

Tax collection and deadlines

With the most important types of tax (corporate income, personal income, trade, and value-added tax) collection is made via advance payments (normally monthly or quarterly) which are offset against the actual tax liability in the annual tax declaration. The tax declaration has to be submitted by 31 May of the following year. However, this deadline can be extended on request.

Register of tax advisors

Subject to the expected amount of taxes to be paid, the tax authorities can determine the period when tax payments are due. The tax authorities provide information on tax issues. However, companies in particular should seek the services of a tax consultant to ensure the tax return is completed as favorably as possible. The German Association of Tax Advisers (Bundessteuerberaterkammer) provides a register of tax advisors.

Payment of wage tax

Employees pay wage tax (Lohnsteuer) – a special term for the income tax paid by employees. The employer is obliged to deduct the wage tax due directly from the salary of the employee and to pay it to the tax office on a monthly basis. For this reason, employees who do not get earnings from non-wage incomes may not be obliged to submit an annual tax declaration.

Electronic tax declaration

Tax declarations on income tax, wage tax, and value-added tax can easily be submitted to the tax office electronically. The electronically submitted tax declaration is mandatory for business operators. Information, forms, and software products for submission of an electronic tax declaration are available at the dedicated Elster website.