Taxation of property

Every property owner in Germany is liable to pay real property tax (Grundsteuer). The tax rate depends on the type of real property.

Real property tax rate

Real property in Germany is sorted into two distinct categories. The real property tax rate depends on the category assigned to the property.

Real property tax for undeveloped areas

A real property tax type “C” will be introduced from 2025 onward as the result of a fundamental real property tax reform. Municipalities can impose the real property tax type “C” for undeveloped areas that are ready for development.

-

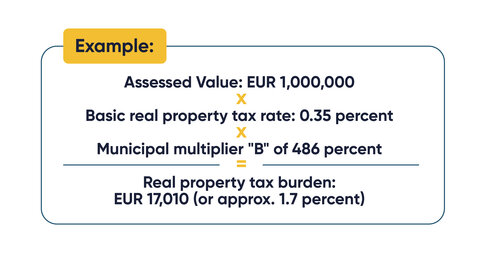

- The real property tax burden is calculated by multiplying the assessed value of the real property with the real property tax rate and the municipal multiplier.

-

- The assessed real property value is determined by the tax authorities according to the German Assessment Code (Bewertungsgesetz).

-

- The German Assessment Code refers to historical property values that are usually significantly lower than current market value.

-

- The tax rate varies between 0.26 percent and 1 percent depending on the Federal State (the real property is located at) and the use of the property.

Municipal multiplier

Similar to the municipal multiplier applied in the trade tax case , the municipal multiplier applied to real property tax is stipulated by each municipality. Municipalities determine a municipal multiplier for both real property tax “A” and real property tax “B”, with the rate for “B” usually being higher.

The Real property tax reform

The reform of real property tax maintains the three-step system for calculating the real property tax rate but makes provision for a new assessment of real property values as of January 1, 2022. The reform also simplifies the calculation from 2025 onward, because it largely relies on average and statistical data to calculate the assessed value of the real property. The German federal states are free to introduce their own deviating provisions in order to impose and calculate real property tax.

Reform of real property tax

Due to a reform of real property tax, the basic real property tax rate ”B“ will be lowered to 0.034 percent or 0.031% (depending on the property type) from 2025.

Real property transfer tax

When domestic real estate is sold or changes owner, a one-time real property transfer tax (Grunderwerbssteuer) of the purchase price is levied if the purchase price or consideration exceeds EUR 2,500. Real property transfer tax is usually paid by the buyer. Real property transfer tax also applies to a real property-owning company if 90 percent of the shareholders change within ten years. The tax rate in North Rhine-Westphalia represents 6.5 percent.